Here's what 120 startups +30 VCs/Accelerators (representing 1200+ startups) recommend. Top voices such as Michael King (Andreessen Horowitz) or Scott Brown (Cervin Ventures) urge b2b tech startups to initiate analyst relations early and strategically. But how early??

The SSIA research 2022 found the majority of analysts want to hear startups' original thinking at beta stage — 1/5 even at MVP stage. And 8/10 analysts seek innovators they can recommend to buyers! Startups didn't quite expect that...

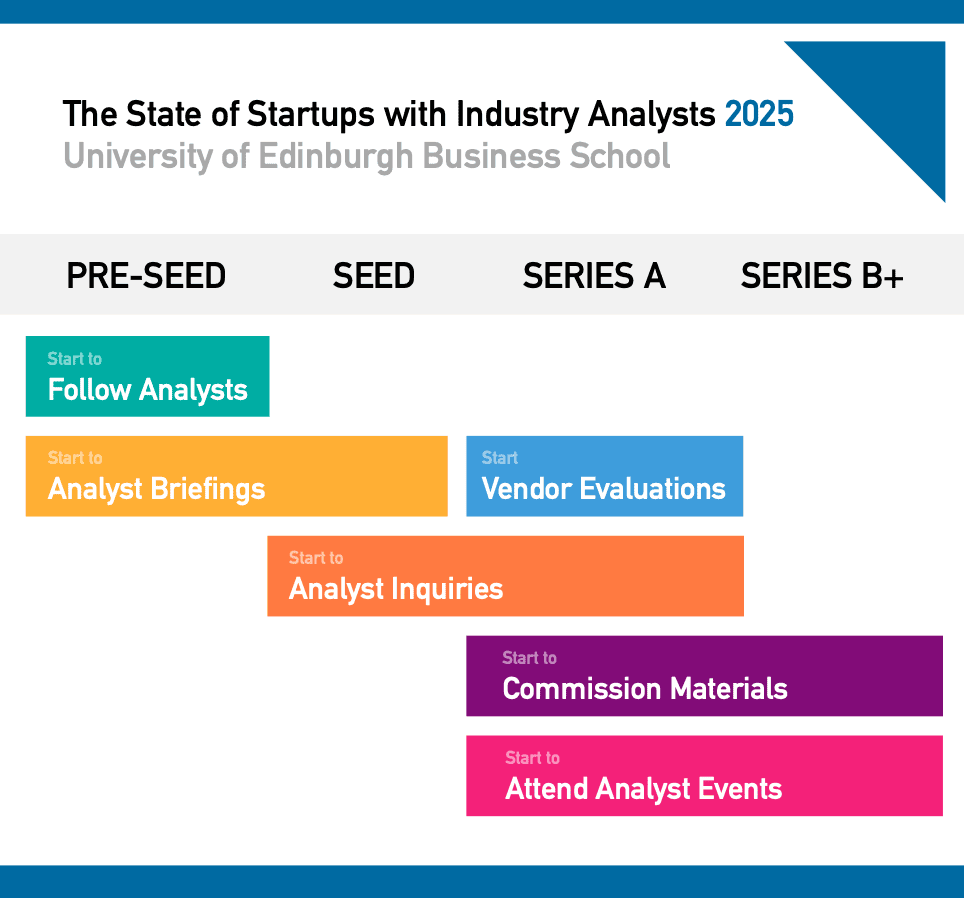

But how does this map to funding stages? The SSIA 2025 research answered this based on startup and VC responses very clearly:

Pre-Seed:

Start to follow analysts in your niche and target industries.

Pre-Seed / Seed:

Conduct introductory briefings.

Seed:

If you can afford it, start doing inquiries. You may want to go with firms that allow for very small packages covering your ICPs before considering more comprehensive subscriptions.

Series A:

Begin to actively contribute to vendor evaluations. Attend analyst events. Consider commissioned research or sales/marketing-supportive materials.

In addition, I also asked startups which AR activity made the key difference and they recommend doing sooner?

I only have a sample of 25 startups and scaleups so far, but the data has stabilised quickly: 52% pointed directly at analyst inquiries!

"Analyst inquiries gave us forward-insights about real-time and reliable priorities of decision-makers in our ICPs." (Luke Grose, CEO at Pace-xl.)

This is something you just can't get from AI: Privileged forward info.

It explains how some startups move so much faster than others, reduce risk and secure better funding to level up and break through.

If you want to understand more about the reality of startup-tailored AR, without falling for mainstream misconceptions, I'm happy to share more VC and SSIA insights, show you proven frameworks others are using and how this might look like for you.